On Tuesday, I published a post about the way in which criticisms of common ownership (i.e. when competing companies are owned by the same group of people such as diversified shareholders) interact with the positions of the new antitrust movement. The post attracted responses from Yves Smith at Naked Capitalism and Matt Levine at Bloomberg. Both pieces are worth reading and below I briefly comment on each.

Yves Smith

Smith’s piece argues that the common ownership of publicly-traded companies is not the cause of our current monopoly problems. In support of this argument, she claims (contra JW Mason) that shareholders are fairly powerless, that monopolistic behavior exists in privately-held companies, and that we had a prior wave of monopoly (think Standard Oil) before modern finance was even around.

These are all good points and they all support the conclusion that common ownership is not the sole cause of our monopoly woes.

But the argument of common ownership critics is not that common ownership alone causes anti-competitive behavior. Rather, it is that it can be a separate cause of anti-competitive behavior. The upshot of their position would be that the normal antitrust remedies of breaking monopolies into multiple companies are necessary but not sufficient for solving the competition problem.

Matt Levine

Levine’s piece focuses exclusively on my argument that common ownership of equity through diversified shareholders “leads directly to the market socialist conclusion.” In response, he writes:

I mean, no, the rise of index funds doesn’t lead directly to market socialism. You can believe that broad common ownership of the means of production can still foster competition, while also thinking that that common ownership should be allocated by capitalist methods. But the experience of index funds probably does make it easier to advocate for socialism: If we all own all the companies, and it’s fine, then maybe it would be fine if we all owned the same amounts of all the companies?

Here is the problem.

This too is true. By themselves, index funds would never cause market socialism to come into existence. But their success should make it a lot easier to argue that a certain kind of market socialism can work.

The most important criticism of socialism historically has been that it is incapable of economic calculation. That is, we need markets and competition to create the sort of information that allows us to rationally allocate productive resources in society. Centrally-planned socialist economies lack a replacement mechanism to do this kind of economic calculation and are thus doomed to inefficiency and failure. Or so the argument goes.

In response to the economic calculation argument, market socialists, most prominently Oskar Lange, proposed a number of simulated competition schemes that would produce useful allocation information without the need for private ownership of businesses and capital. These schemes have never really been tried and have gone mostly ignored.

Index funds are basically an extremely unequal version of some of these socialist simulated competition schemes and thus are a proof of concept for market socialism. To see why I say this, consider the three graphics below in which I move from our current index fund situation to a market socialist situation. While looking through these graphics, you should be asking yourself the question: at what point does economic calculation become a problem? If the answer is “at no point,” then, my friend, you believe in the viability of simulated competition in a market socialist system.

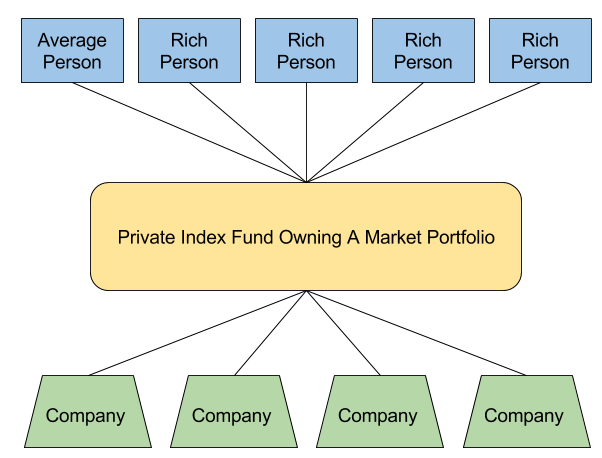

Here is our current index fund situation:

At the top, we have the individuals that have money in the index fund. These individuals are mostly rich people, especially if you weight it by how much money each person has in the fund. There are a few middle-class people in there, but no poor people.

In the middle we have an index fund, e.g. Vanguard. The hypothetical index fund here owns a market portfolio, meaning it is diversified across all the companies in the country.

On the bottom row, we have all the companies the index funds owns shares of.

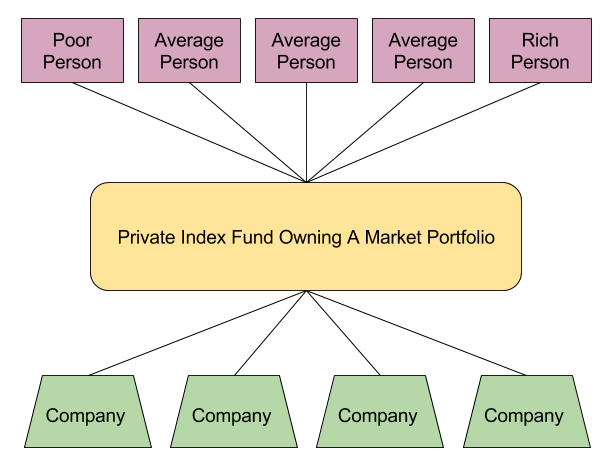

In this next graphic, we have the exact same situation as the first one, except I have redistributed all of the money in the fund to everyone in society (note the change on the top row):

Now, instead of the account holders in the index fund being mostly rich people, the account holders are everyone in the country, and the account holders all have an equal amount of money in the fund.

Would this change make economic calculation impossible? No. It doesn’t matter to the companies who owns the shares of the index funds that own them. Their behavior would not be altered in the slightest. So if economic calculation is possible in graphic one, then it is also possible in graphic two.

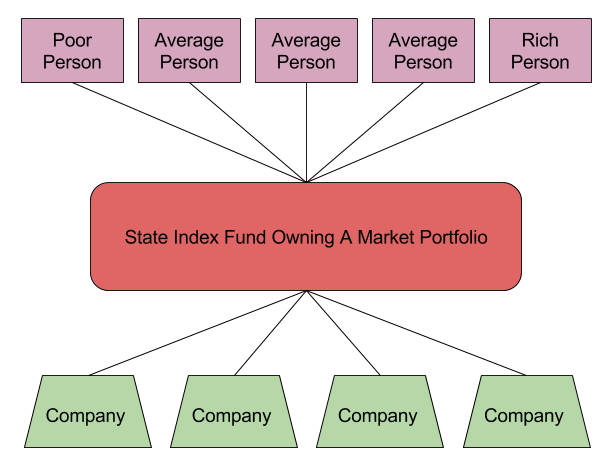

In this last graphic, we have the exact same situation as the second graphic, but I have replaced the private index fund with a state-owned index fund:

Once again, the question arises: is economic calculation possible? And the answer, it seems, is yes. There is nothing about having the state operate the index fund that should alter the ability to do economic calculation. Provided the companies all compete against one another just like they do in the first two graphics despite being commonly owned by diversified shareholders, it certainly looks like the system would work.

Indeed, we already have funds that basically operate like this in the world. Most notably there is the $975 billion Norwegian social wealth fund, which currently owns a diversified portfolio of equity, bonds, and real estate. They describe their fund as “the people’s money, owned by everyone, divided equally and for generations to come.” There is also the Alaska Permanent Fund, which is much smaller, but has the more interesting quality of paying an annual dividend to all of the citizens of Alaska, just like private index funds pay a dividend to all those invested in it.