The Child Tax Credit is a welfare benefit provided to families with children. Currently the CTC benefit phases in at 15% after the first $3,000 of labor income and maxes out at $1,000 per child. Senators Marco Rubio and Mike Lee propose to change the CTC to a benefit that phases in at 15.3% starting at $0 of labor income and maxes out at $2,000 per child.

| Detail | Current | Rubio-Lee |

| Labor Income Start Point | $3,000 | $0 |

| Phase-In Rate | 15% | 15.3% |

| Maximum Amount | $1,000 | $2,000 |

When asked why they want to move the labor income start point up to $0 and increase the phase-in rate to 15.3%, Rubio and Lee generally say that the point is to offset low-income workers payroll tax contributions.

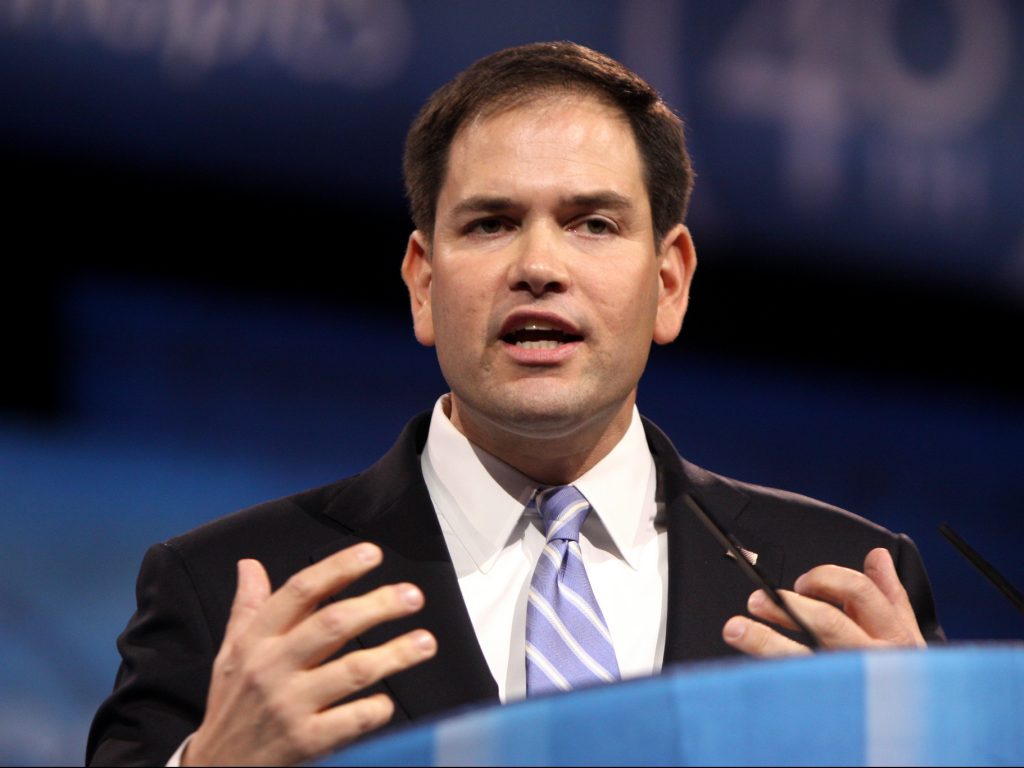

Disrespectful & wrong to argue that lower income workers don’t pay taxes. #ChildTaxCredit should apply to payroll tax not just income tax

— Marco Rubio (@marcorubio) November 16, 2017

The way that they derive the 15.3% phase-in rate figure is by adding up the following tax rates:

- Employee-Side Social Security Tax — 6.2%

- Employer-Side Social Security Tax — 6.2%

- Employee-Side Medicare Tax — 1.45%

- Employer-Side Medicare Tax — 1.45%

Since 6.2 + 6.2 + 1.45 + 1.45 = 15.3, Rubio-Lee argue that a 15.3% phase-in rate starting at $0 of labor income merely refunds to workers the amount they would have made if they had not been subjected to federal payroll taxes. And, as you can see in the tweet above, they are pretty defensive about this particular justification for it.

On its face, this justification doesn’t really make any sense, given the fact that the Earned Income Tax Credit exists. The EITC phases in at 34% starting at $0 of labor income for a family with one child, 40% for a family with two children, and 45% for a family with three children. This means that the EITC already achieves the purpose of refunding payroll taxes to low-income workers (and then some). Changing the CTC phase-in structure in the way Rubio and Lee proposes would mean that payroll taxes are being refunded two times!

In any event, if your goal is to construct a CTC phase-in structure that mirrors payroll tax liability, the 15.3% phase-in rate is actually too low. They derive that rate by adding up both sides of the Medicare and Social Security taxes, as explained above. But Medicare and Social Security are not the only federal payroll taxes. There is also the Federal Unemployment Tax (FUTA).

The FUTA imposes a 6% employer-side payroll tax for the first $7,000 of labor income. A CTC that properly refunded all federally-imposed payroll taxes would phase in at 21.3% for $0 to $7,000 of labor income, and then the phase-in rate would drop down to 15.3% for labor income over $7,000.