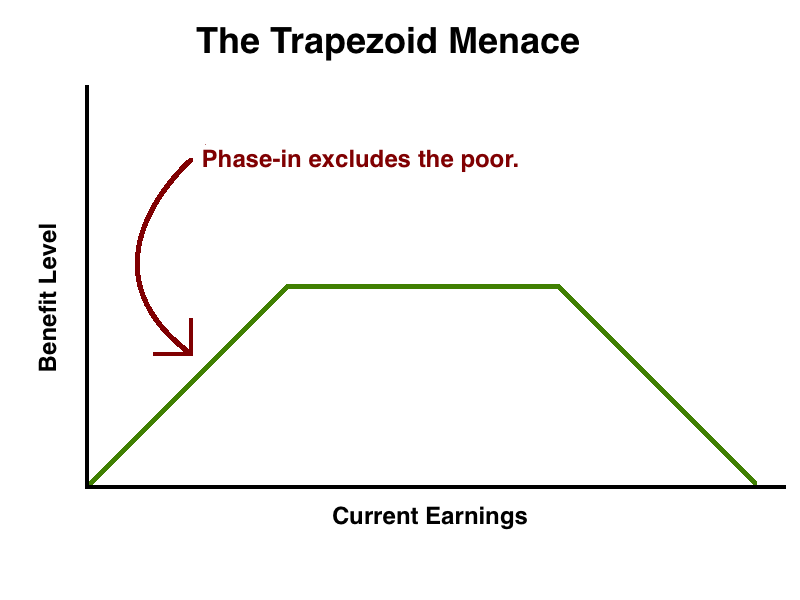

In the last couple of years, Democratic politicians and policymakers have put forward a variety of transfer programs that are supposed to tackle inequality. Each has their own fanciful acronym — GAIN, LIFT, RISE, UEITC — but they are all fundamentally the same: a refundable tax credit that phases in based on earnings and then (with the exception of UEITC) eventually phases out based on earnings. This is the much hated trapezoid design that cruelly and unnecessarily excludes the poor.

We at People’s Policy Project have been begging lawmakers in our own publications and in statements made to other publications to stop introducing trapezoid programs. Specifically, we have called for lawmakers to stop excluding the poor by phasing in benefits based on current earnings.

Rashida Tlaib has now released a proposal, which she is calling LIFT+, that does not phase in. Under LIFT+, individuals will receive $3,000 per year and joint filers will receive $6,000 per year as a supplement to whatever other income they might have. The benefit phases out for individuals who have income above a certain threshold, but it does not phase in, meaning that even those without earnings are eligible.

Tlaib’s proposal is a major leap forward for the welfare state discourse in DC. For the last few decades, that discourse has been dominated by scolds like CBPP’s Bob Greenstein and TPC’s Len Burman who loudly proclaim to anyone who will listen, including lawmakers that rely on outside institutions when crafting policy, that it is unserious to propose income support expansions that include the very poor. Burman is so obsessed with this opinion that he goes as far as to cite bizarre evolutionary psychology reasons for why human beings will not tolerate a tax credit that has no phase in.

But political impossibility is not a permanent thing. A few years ago, it would have been impossible to imagine anything but more trapezoidal nonsense out of the Democrats. Indeed, even after CBPP and CAP shifted their position to be in favor of creating a child benefit that does not phase in based on parental earnings, Hillary Clinton nonetheless proposed a child benefit with a phase in, which those two organizations then praised effusively despite having made the case themselves for why phasing in child benefits is bad policy.

Now we have a prominent member of Congress in Tlaib who is breaking the trapezoid curse and offering up a program that does not cruelly exclude the poor based on speculations about political expediency. Folks like Burman will no doubt continue to proclaim policies like LIFT+ are political non-starters. In fact, Burman took to the Washington Post yesterday to say just that. But despite all that huffing and puffing, the LIFT+ credit is a live policy idea likely to gain a significant number of cosponsors once introduced, while Burman’s VAT-funded UEITC is unlikely to even get off the ground.

Who is the politically practical one now?