Michael Bennet and Mitt Romney released a Child Tax Credit proposal last night. When reorganized logically, the proposed CTC has three pieces:

- $1,000 CTC that phases in at a 15 percent rate for all children.

- $1,000 CTC that is fully refundable for all children.

- $500 CTC that is fully refundable for children ages 0 to 6.

Thus, young children would receive $1,500 in fully refundable benefits while older children would receive $1,000 in fully refundable benefits. Both would then receive an additional $1,000 in benefits if their parents’ earnings are high enough.

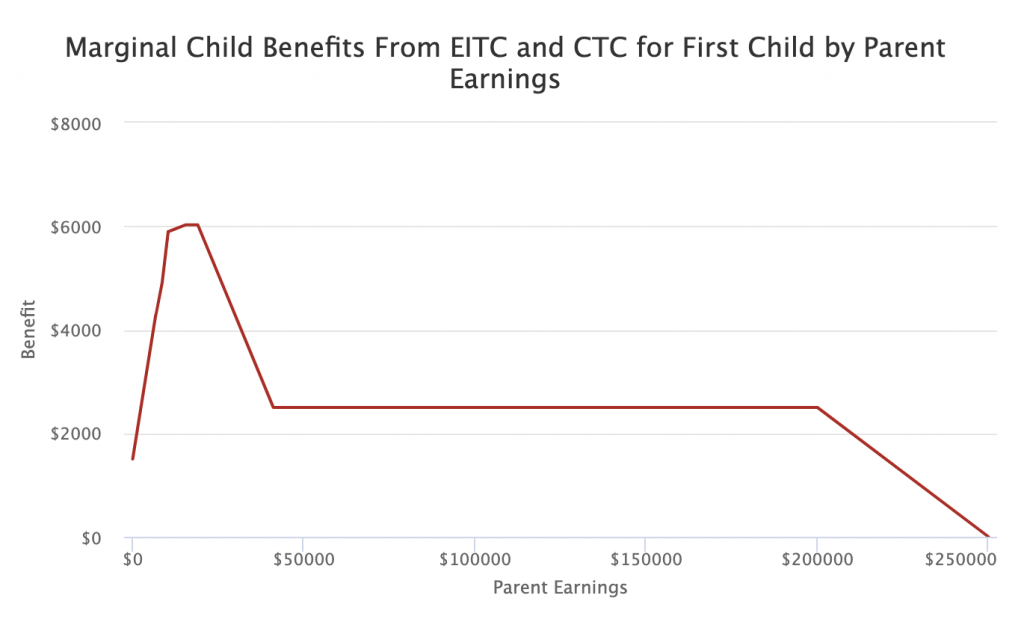

The purpose of child benefits is to increase the disposable incomes of families who are caring for children. This is necessary to reduce inequality between families with different numbers of kids. Thus the best way to understand the child benefits scheme envisioned by the Bennet-Romney proposal is to look at how much money families would receive from the EITC and CTC when they have their first child.

Under this scheme, the poorest families will receive an additional $1,500 per year when they add a child to their family, i.e. when they become a one-child family relative to a zero-child family. Families with earnings of $19,030 will receive $6,026 per year, four times as much as the poorest families. Families with earnings of $200,000 (single filers) or $400,000 (married filers) will receive $2,500 per year, 66 percent more than the poorest families.

Needless to say, this is a completely insane way to design a child benefit regime. An ideal design would have no phase-in or phase-out, meaning that every family gets the same child benefit regardless of their earnings. Short of that ideal design, there should at least be no phase-in. Phase-ins cruelly deprive the poorest children of benefits and do not even achieve their alleged purpose of motivating people to work.

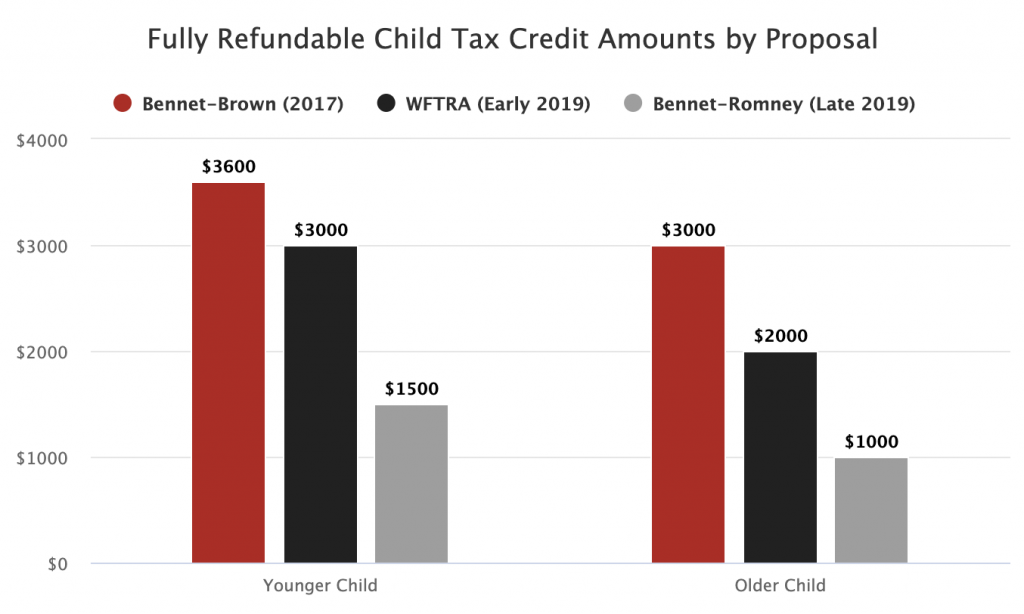

Michael Bennet, and other Democratic politicians, have maintained this bad design approach over the past couple of years despite criticism, while also consistently lowering the benefit amounts being proposed even as nobody has criticized the amounts as being too high. The Bennet-Romney proposal is now a mere shadow of the Bennet-Brown proposal from two years ago.

Creating a family benefits regime that is easy to use and coherent is not a particularly difficult thing to do. Our Family Fun Pack proposal shows how it is done. When it comes to providing a cash benefit for families with children, the best solution is also the easiest: have the Social Security Administration send the same amount of money every month to every family for every child they are currently taking care of, e.g. $300 per month.