Since the 1990s, America has had a very specific goal when it comes to cash benefits for families with children: keep them away from very poor people. I find this goal to be quite cruel, but the logic of it was clear enough. By making lives unspeakably miserable for the very poor while providing decent benefits for those a rung above them, we incentivize the very poor to work and ensure only the virtuous receive social benefits.

The Child Tax Credit (CTC) was reasonably well designed to achieve this goal. By delivering the benefit at the end of each year through the tax system, we can identify who the poor are. And by basing the benefit on earnings and tax liability, we can exclude them.

For as long as the goal is to exclude the poor, the CTC makes a lot of sense. But the second you decide that is not your goal anymore and that you want the poor to receive cash benefits too, the CTC no longer makes sense as a benefit delivery system. Instead, a universal child benefit becomes the inarguably best way to achieve your new goal.

To see why this is the case, I thought it might be useful to compare three different ways of delivering a poor-inclusive child benefit.

- American Family Act (AFA). This approach provides each kid a monthly check that phases out based on a family’s estimated earnings and tax liability for the current year.

- Canada Child Benefit (CCB). This approach provides each kid a monthly check that phases out based on a family’s actual earnings for the prior year.

- Universal Child Benefit (UCB). This approach provides each kid the exact same gross monthly check. A tax is then separately applied to achieve a result similar to a phase out based on a family’s actual earnings for the current year.

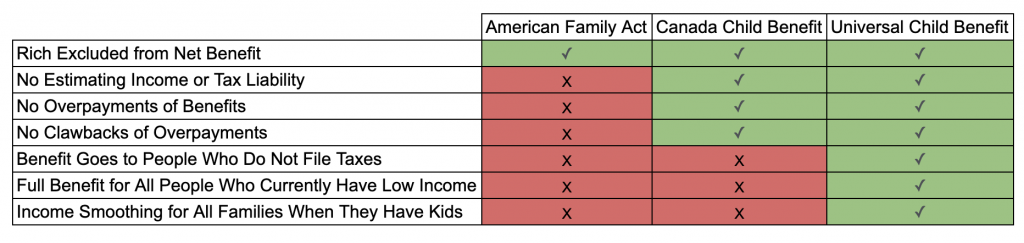

To see how these three benefits stack up against one another, I created the handy table below.

The only thing the three benefits have in common in the table is that they all prevent the rich from receiving a net benefit from the program. This is important to highlight because almost everyone misunderstands this fact. Phasing out the gross benefit payment, as the AFA and CCB do, is not the only way to ensure the rich do not receive a net benefit. You could also provide every kid the same gross benefit payment and ensure the rich receive no net benefit by applying a separate tax, which is how the UCB works.

Not only can you do it this way, but you should do it this way. Every other way of designing the child benefit creates problems that the UCB does not have.

If you try to implement a phase-out based on current-year earnings and tax liability, as the AFA does, then you have to require people to estimate their income or tax liability in advance every year. This then ensures that some people will accidentally underestimate their current-year earnings, leading to overpayments and surprise tax bills at the end of the year (i.e. clawbacks). People who fail to file their earnings estimates will also not be able to receive benefits.

You can fix some of these problems by trying to implement a phase-out based on prior-year earnings, as the CCB does. Since prior-year earnings are already known and recorded, phasing the benefit out in this way means that people do not have to provide earnings or tax liability estimates, which also therefore means there can be no overpayments resulting from underestimates and no clawbacks resulting from overpayments.

However, by basing the benefit on the prior year’s tax return, you exclude people who fail to file taxes. You also make it so that people who currently have a low income but had a high income in the prior year do not receive the child benefits they need to stay afloat, creating precisely the kind of unnecessary poverty and hardship that the child benefit is supposed to be solving.

The final problem caused by the CCB, which is also present in the AFA, is that the use of a phase-out rather than a tax means that the program cannot provide income-smoothing to high income families. This is a rarely-discussed downside of phase-outs that I think many people struggle to wrap their heads around it.

Income-smoothing is one of the core functions of the welfare state and it works by ensuring that people receive transfer payments to offset financial shocks. Adding a child to a family creates a financial shock in that the presence of the child increases the income needs of the family. Crucially, this shock occurs for all families even affluent ones.

A UCB smooths over this income shock for everyone because, under the UCB, all families receive an income boost upon adding a child to their family relative to before they added a child to their family. This happens because the tax that is coupled with the UCB is applied to all taxpayers regardless of the number of children they have. Since all affluent people are always charged the “UCB tax” every year, their tax level does not change upon having a child. But their child benefit amount does go up when they have a child, meaning that their disposable income rises, helping to offset the financial shock of having a kid.

The AFA and CCB do not work like this because they rely upon benefit phase-outs that only apply to affluent people who currently have kids rather than taxes that apply to all affluent people. This means that, under the AFA and CCB, the financial shock of having a child is not offset at all for richer people. To reiterate what I said above, the phase-out does not make the AFA or CCB less costly than the UCB and it does not make them exclude the rich from net benefits more than the UCB. It’s the same cost and same level of exclusion, just without the income-smoothing for the rich.

Income-smoothing for the rich is not the most important thing in the world of course. But it is worth highlighting, not only because it is one of the things the UCB can do that no other design can, but also because it underscores that it really is possible to create a benefit that helps absolutely everyone in some way. This is the genius of tax-funded universal benefits in a nut shell. They have fewer administrative problems than phased-out benefits do; they soak the rich more than phased-out benefits do; and yet they still manage to help everyone, including the rich, by, at the very least, smoothing income.

The UCB is the perfect child benefit. Every modification you make to it can only make it worse and can never make it better.