On Friday, Jeff Stein reported that key Congressional Democrats recently modified a proposal to create a fully refundable Child Tax Credit to address some of the problems raised by policy commentators such as myself.

This is encouraging. Was this your effort @MattBruenig. We need to fight for the child allowance and get it over the finish line. https://t.co/FSfs8Mc1l8

— Ro Khanna (@RoKhanna) January 22, 2021

The modified proposal is an improvement, but the new proposal still has design problems that do not need to exist and is confusing in certain respects.

The Old Proposal

The old proposal, which was called the American Family Act, provided a $3,000 per child per year benefit that started phasing out at $130,000 of income for single parents and $180,000 of income for married parents. Families who expected to have an overall negative tax liability for the year could receive an advanced monthly version of the benefit. The ability to claim these advanced monthly refunds phased out very early and very quickly because even people with fairly modest incomes typically have some federal income tax liability.

The following graph sums up what this looked like for a one-child, one-parent family.

This design had a variety of serious problems, including the following:

- The quick phase-out of the advanced refunds would create frustration, confusion, and resentment for those who do not get them and feel like they aren’t benefiting from the program.

- To receive advanced refunds, individuals would need to file what amounted to a second speculative tax return each year, which would be administratively burdensome and too difficult for many people to do.

- The advanced refunds would be based on someone’s expected income and tax liability for the year. If those expectations ended up being wrong, individuals would receive benefit overpayments that would be clawed back at the end of the year in the form of a surprise tax bill of potentially thousands of dollars.

The New Proposal

Under the new proposal, as reported by Stein, the distinction between the total credit amount and the advanced monthly refund amount is eliminated:

Families would receive the monthly benefits even if they owe the government more in taxes than the value of the credit.

Put differently: all individuals will receive a monthly payment equal to their total credit amount. This will vastly increase the number of people who get the full payment each month. This does not increase the fiscal cost of the program. It just changes how the cash flows are administered to make the benefit less opaque to middle class families.

“This will have more collective buy-in if a broader swath of the population directly receives the payment,” one senior Democratic aide involved in drafting the legislation said, citing the popularity of the stimulus payments.

Both the change and the reasoning behind the change are a big deal within the welfare policy world. The change shifts the program much more in the direction of a universal child benefit and the reasoning behind the change is the social democratic logic that Democrats have historically been reluctant to adopt.

The other change, which attempts to address problems (2) and (3) from above, is to base each family’s credit amount on their actual income from the prior year rather than their expected income from the current year. This would eliminate the need to file a second speculative tax return each year, which would lower the administrative burden. It would also make it impossible to receive an overpayment resulting from incorrectly estimating your income, which would eliminate the surprise tax bills contained in the American Family Act.

As I noted last week, the new proposal looks more like the Canada Child Benefit (CCB) than the American Family Act. And so it avoids a lot of the problems of the American Family Act, which were also present in similarly-designed programs in Australia and the United Kingdom.

Remaining Problems

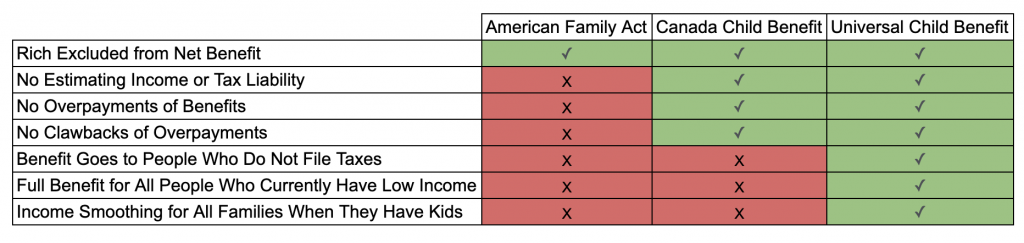

As indicated in the table above, there are three remaining problems with this new CCB-style design.

The first problem is that the proposed design still uses a benefit phase-out rather than an income tax in order to ensure that affluent families do not net benefit from the program. A phase-out is inferior to a tax because a tax hits all affluent families while a phase-out only hits families with children. By hitting all affluent families, you broaden the base, which allows you to lower the tax/phase-out rate (e.g. from 5 percent to 3 percent) and you also ensure that high-earning families with children receive more disposable income than high-earning families without children, which serves income-smoothing as well as egalitarian purposes.

The second problem is that the proposed design would exclude people who do not file taxes, which is currently millions of people per year. One response to this might be that every child benefit design is going to require people to sign up in some way and so this is not a problem unique to relying on prior-year tax returns to sign up. While this is true, some benefit designs are less burdensome than others. Countries that use a universal child benefit have people sign up at the hospital when they give birth and then provide the benefit automatically from there with no further paperwork needed. This is less administratively burdensome than requiring that people file an annual tax return and therefore would exclude fewer people.

The third problem is that the proposed design would fail to provide timely benefits to families that had a high income last year but have a low income currently. It is this problem that staffers appear to be confused about.

If you are going to phase-out a child benefit, you need to input an income into the phase-out formula for every family in the program. You can get that income value from two places: (1) estimates of someone’s current-year income or (2) records of actual prior-year income.

If you use option (1), then you create a huge administrative burden and generate lots of benefit overpayments and clawbacks. That was the AFA approach that the new proposal reportedly abandons for option (2).

But if you use option (2), then the income being inputted into the phase-out formula is out of date. Some people who are currently very poor and who really need the child benefit to stay afloat will not get it because they had a high income in the prior year. They will be eligible for it again in the subsequent year but, by then, it may be too late.

Both outcomes are bad, but if you are going to apply a phase-out, then this is the dilemma you set up for yourself. The reason I say the staffers seem confused about this is because, in Stein’s story, they appear to be trying to have it both ways:

The Democratic proposal is also expected to phase out above a certain income, meaning affluent families would not receive it. Eligibility would be based on family income in the prior year, much like eligibility for the stimulus payments. Taxpayers could use the new Treasury Department portal to update their status if they experienced dramatic income declines, according to the people familiar with plans, who stressed that these decisions had not been finalized.

The reason this is confused is that, if you are basing benefit eligibility on prior-year income, then changes in current-year income are irrelevant to current-year eligibility. Your current-year income determines your next-year eligibility. It does not determine your current-year eligibility.

I supposed you could imagine a child benefit where the phase-out is based on the lesser of your prior-year income and your estimated current-year income. It’s not clear if that is what they have in mind, but if so, this does not get you out of the dilemma. Instead, it results in a system where the problems of both approaches are present. Creating a default arrangement where people receive benefits based on their prior-year income will result in some people not getting the benefits they are owed because they do not successfully navigate the bureaucratic hoops to register their income decline. Allowing people to override prior-year income with current-year estimates will result in some people underestimating their income, generating overpayments and clawbacks.

This kludge, although unclear and ineffective, is based on an admirable intent. The staffers appear to be trying to create a child benefit (1) that the rich do not net benefit from, (2) that is administratively easy, (3) that lacks overpayments and clawbacks, and (4) that is responsive to someone’s current income. But this combination is simply not possible with phase-outs.

To achieve these four goals, what you need is a universal child benefit that pays the exact same check to every family and then uses the regular tax system to ensure that affluent people do not net benefit from the program. This is the most administratively easy design, ensures there are no overpayments or clawbacks, and is based solely on someone’s current income since that is how taxes are assessed.

The universal child benefit is the perfect way to design a child benefit. It does everything right and nothing wrong. Every deviation from it introduces problems that the UCB does not have. The new proposal takes promising steps in the direction of a UCB but there is no reason why it should not go all the way.