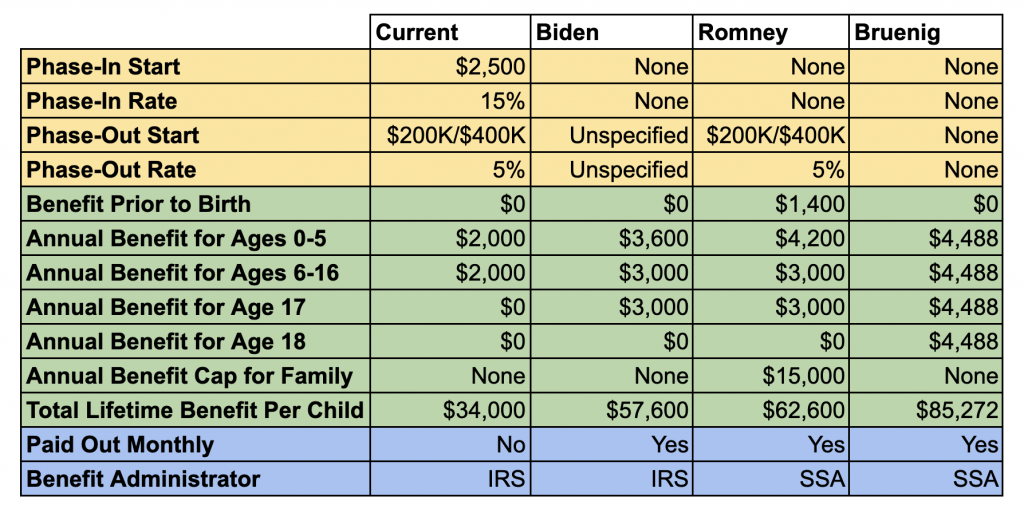

Yesterday, Mitt Romney released his child allowance proposal. The following table summarizes his plan and compares it to the status quo, the Biden proposal, and my own proposal from earlier this year.

In my piece discussing the Romney plan, I criticized the fact that he phases the benefit out at $200,000 for single filers and $400,000 for married filers. I also criticized the $15,000 per year benefit cap, which effectively means that families with more than 3.5 to 5 kids will receive less than the full benefit.

Bad Designs

These are bad design choices because they both create administrative headaches that don’t need to exist.

Additionally, in the case of the phase-out, the design makes it so that high-income families do not receive a disposable income boost when they have a kid, depriving them of the benefits of income-smoothing and making it so that their standard of living is lower than their childless peers.

And, in the case of the benefit cap, the design deprives large families of their fair share, causing them to have lower standards of living than smaller families. It also requires some kind of surveillance apparatus to ensure that families with kids over the amount don’t attempt to defraud the welfare office by, e.g., having dad claim some of the kids and having mom claim the others.

No Meaningful Savings

Now you might say these are problems worth dealing with in order to save a bunch of money. This is of course confused in the case of the phase-out since phase-outs don’t save any more money than using an equivalent tax does. But even if you ignore that confusion, the reality is that these two restrictions — the child caps and the phase-out — don’t save much money at all.

Using the 2019 Current Population Survey, I first looked at how much it would cost to provide $4,200 for every child between the ages of 0 and 5 and $3,000 for every child between the ages of 6 and 17. When done universally, the cost is $247 billion.

From there, if you cap each tax unit’s benefit at $15,000, the cost goes down to $245 billion, a savings of just $2 billion, or 0.8 percent.

In order to run up against the $15,000 cap, you need to have 6 kids between the ages of 6 and 17 or 4 kids below the age of 5 or some combination of kids in each age group. The reason this doesn’t save any money is because (1) very few people have that many kids, (2) even people who have that many kids over the course of their life do not have all of them simultaneously and so for many of their parenting years, they are still eligible for the full benefit, and (3) the amount saved is only the difference between $15,000 and what their benefit would be without a cap, which is itself a modest amount in most cases.

From the universal benefit starting point, I also applied the benefit phase-out for those with high incomes. By itself, that saves only $5 billion. In concert with the $15,000 cap, the total savings is just $7 billion, or 2.8 percent. It’s basically nothing.

Of course, the point of these rules is probably not the savings they generate. It is a political gesture meant to forestall dumb objections that dumb people make about hypothetical families with 10 kids or millionaires getting benefits. But the administrative burdens of enforcing these rules will create hassle for everyone, not just those affected, and will waste real resources on enforcement and surveillance that simply does not need to exist.

Novel Phase-out Design

Although the phase-out shouldn’t exist at all, I do want to highlight the novel approach to it taken by the Romney team. Normally, when phasing out a benefit, you get an income value for each family, either from their estimated current income or actual prior income, and then you use that value to reduce the size of their benefit check.

In Romney’s case, he is having the Social Security Administration send out the full check amount to everyone, even the very rich. So no income value will be needed at that point in the process.

Later on, when people go to file taxes, families will report their income, and their tax bill will increase by 5 cents for every dollar of income beyond $200,000 (for singles) and $400,000 (for married couples), with the total tax increase limited by the amount of child allowance they received.

This is for sure an improvement over the usual way phase-outs are administered. But that’s because it really is just indistinguishable from increasing the income tax rate by 5 percentage points for a certain chunk of income over the phase-out thresholds, except that the 5 percentage point tax rise is only applied to families with children. If you apply that tax rise to families without children as well, you could bring the rate down to, e.g., 3 percentage points, and eliminate the “phase-out.” Aside from the semantics of doing this, this move would be distributively better and it would eliminate the need to report child benefit amounts to the IRS each year.

Romney’s benefit is 97.2 percent of the way to a universal child benefit, which is what makes it exciting. But it should go all the way to 100 percent. Perfection really is possible and cheap in this case.