Congressman Richard Neal released his version of a fully refundable advanced monthly Child Tax Credit, in line with what Joe Biden proposed earlier this year. The proposed annual CTC amount is $3,600 for children between the ages of 0 and 5 and $3,000 for children between the ages of 6 and 17. The benefits begin to phase out at $112,500 of income for single parents and $150,000 of income for married parents.

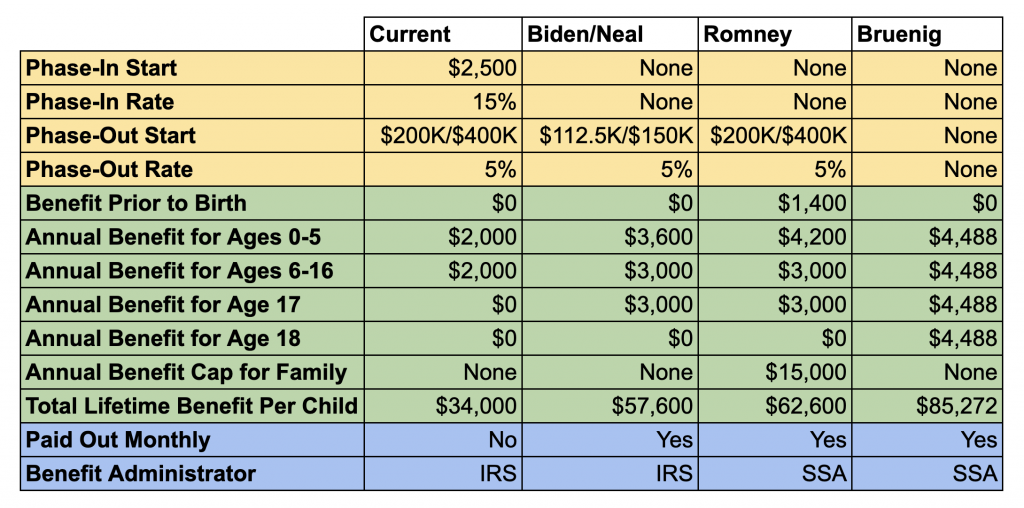

The following table provides a condensed summary of the Biden/Neal proposal, the Mitt Romney proposal from last week, and my own proposal from last month.

Goofy Phase-out Design

The phase-out in the Neal CTC is not as simple as this table suggests. Each tax unit’s CTC amount begins phasing out at $112,500 for single parents and $150,000 for married parents. But that phase-out is limited by a separate rule that says no tax unit can see their benefits cut back from the current CTC scheme, which provides a $2,000 benefit that phases out at $200,000 for single parents and $400,000 for married parents.

When you put these two features of the program together, the actual phase-out being proposed looks like this.

A phase-out that starts and then stops and then starts again obviously looks goofy as hell. But I suppose it’s not a huge issue in and of itself.

The Advanced Payment Mechanics

The real problem with this proposal is how they attempt to implement an advanced monthly payment of the annual CTC amount.

To understand why their approach is so messed up, it’s useful to take a step back and describe the contours of the problem they are trying to solve.

To compute each tax unit’s annual CTC benefit, you must first know the following three things about them: 1) their income for the year, 2) how many children they lived with for 51 percent of the year, and 3) their marital status on December 31. The problem is that you can’t actually know any of these three pieces of information until the end of the year, which means you can’t know how much each tax unit’s CTC benefit is until the end of the year, which means you can’t know how much their advanced monthly CTC benefit should be.

Insofar as determining a person’s benefit eligibility based on information from the future is impossible due to the way that time works, Neal has to come up with some other source of information to plug into the benefit formula. The other source of information he chose is each person’s most recent tax return, which is on file with the IRS. Specifically, under the Neal proposal, the IRS is instructed to assume that every person has the exact same income, number of qualifying children, and marital status as they did in their last tax return, which could be as much as 16 months out of date.

This old information will not actually determine how much benefit you are ultimately eligible for. That determination will be based on your income, number of qualifying children, and marital status in the current year. Instead, the old information is essentially being used as an estimate for what your current-year situation will look like.

If your current-year situation turns out to be different than what was on your last tax return, then your advanced monthly payments, which are based on the old information, could be incorrect, meaning that you could end up receiving too much money during the year or too little.

In the case where you receive too little money during the year, e.g. because your income dropped a lot from your prior tax return, the IRS will provide you a lump sum that makes you whole when you file your taxes at the end of the year. This money therefore arrives too late to help you with your income decline, though it does eventually make it to you.

In the case where you receive too much money during the year, e.g. because your income increased a lot from your prior tax return, the IRS will claw back the overpayments via a surprise tax bill that could be thousands of dollars high.

The Neal proposal does contain a narrow safe harbor for people who wind up with overpayments owing to the fact that their number of qualifying children went down. The safe harbor offsets $2,000 of overpayment per kid, meaning that the tax unit is still on the hook for $1,000 to $1,600 of overpayments per kid. The safe harbor is not available for tax units with incomes over a certain threshold. The safe harbor is also not available to offset overpayments that result from other changes, such as changes in income or changes in marital status. Those overpayments will be entirely clawed back via a surprise tax bill.

The Neal proposal instructs the IRS to create an online portal that people can use to update their information in the middle of the year if their income, marital status, or number of qualifying children change. But this does not really solve any problems because, even if you use the online portal to change your information in, say, July, you will still have received overpayments in the six months prior to July. Also, since July is not the end of the year, you still won’t know what your actual information for the year should be, and so these mid-year adjustments will also be error-prone. Of course, the bigger problem with this online portal business is that it is highly doubtful that anybody will actually use the portal to begin with.

Please Don’t Do This

The sad thing about all of this is you can see exactly why this proposal has wound up in such a messed up place administratively speaking. Early on, someone convinced Brown and Bennet that we could create a child allowance type system in the US by making the CTC fully refundable and paying it out monthly. From there, that idea gained a lot of traction without anyone ever really thinking hard about how exactly you would do something like that.

Biden’s team got him to sign on to the high-level idea and now policymakers are faced with the daunting task of making a bad idea into somewhat workable policy, resulting in this kludgy mess that is now being offered up to the public.

The CTC makes sense for its current purpose, which is to provide cash benefits to families with children in a way that excludes poor families. But as soon as you say you no longer want to exclude poor families and that you want to pay the benefit out monthly, the CTC no longer makes sense as a benefit delivery device. The reason the design described above is so bad is not because the people who had to fill in the details are incompetent, but rather because the task they were given — create an advanced monthly CTC that pays money out in the same way as our current annual CTC — is impossible to do well.

The good news is that there is still time to design this benefit the correct way. Instead of this mess, Congress should create a universal child benefit that pays out the same monthly benefit (not a monthly version of an annual benefit) to all parents, regardless of their income or marital status. In order to ensure that the rich do not net benefit from this change, all you have to do is change the federal income tax rates so as to mirror the proposed phase-outs. For the Neal plan, that means increasing the marginal tax rates by 5 percentage points for incomes beyond $112,500 for singles and $150,000 for married couples.

This is essentially what Mitt Romney has proposed in the Senate. In his proposal, the Social Security Administration pays out the same child benefit to all families. The money that is sent to the rich is effectively recouped through a 5 percentage point tax rate rise for incomes beyond $200,000 for singles and incomes beyond $400,000 for married couples. Providing the gross payment to everyone and then using the tax system to implement the “phase-out” in this way makes it easy for employers and individuals to simply adjust their tax withholding systems (just as they did after TCJA was passed), obviating the need for any of this complicated and painful means-testing machinery.

The Democrats should borrow this aspect of Romney’s proposal, even if they don’t borrow anything else about it.