Earlier this year, the Biden administration signed into a law a reform of the Child Tax Credit that increased benefit amounts from $2,000 per year to $3,000 per year, made the payments available monthly, and made the poorest families in the country eligible for the program. In their messaging, the administration mostly touted the latter reform, claiming that it would cut child poverty in half.

But making poor people eligible for the program is not the same thing as enrolling them in it. Many poor people do not file tax returns and so the IRS does not have their information on file. The IRS also does not have benefit offices sprinkled throughout the country because they are a tax agency and because they effectively outsource the customer service aspects of tax-filing to private companies like H&R Block and Liberty Tax Service that operate seasonal offices.

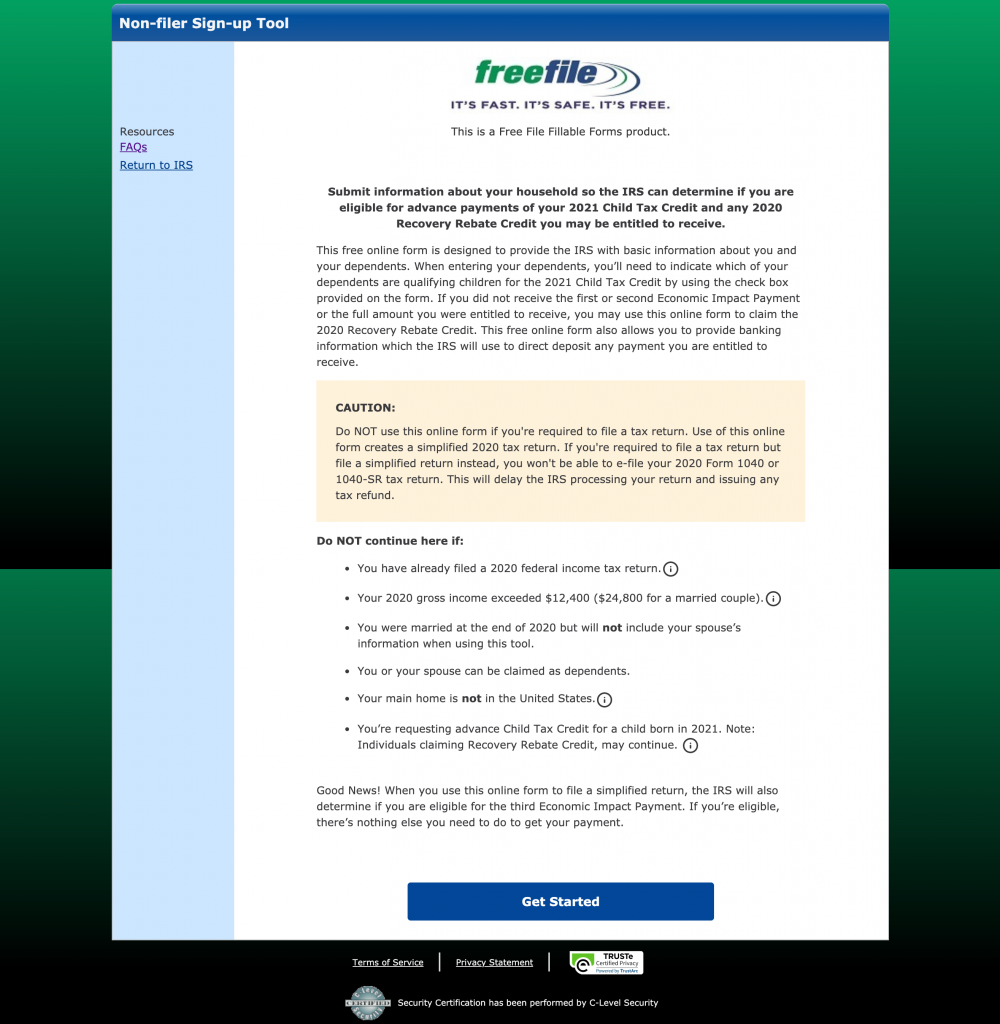

Given all this, the only thing the IRS could really do was set up a website for non-filers to sign up for the new CTC and hope that those non-filers find their way to it. They had months to set up this website. And this was the result of their efforts.

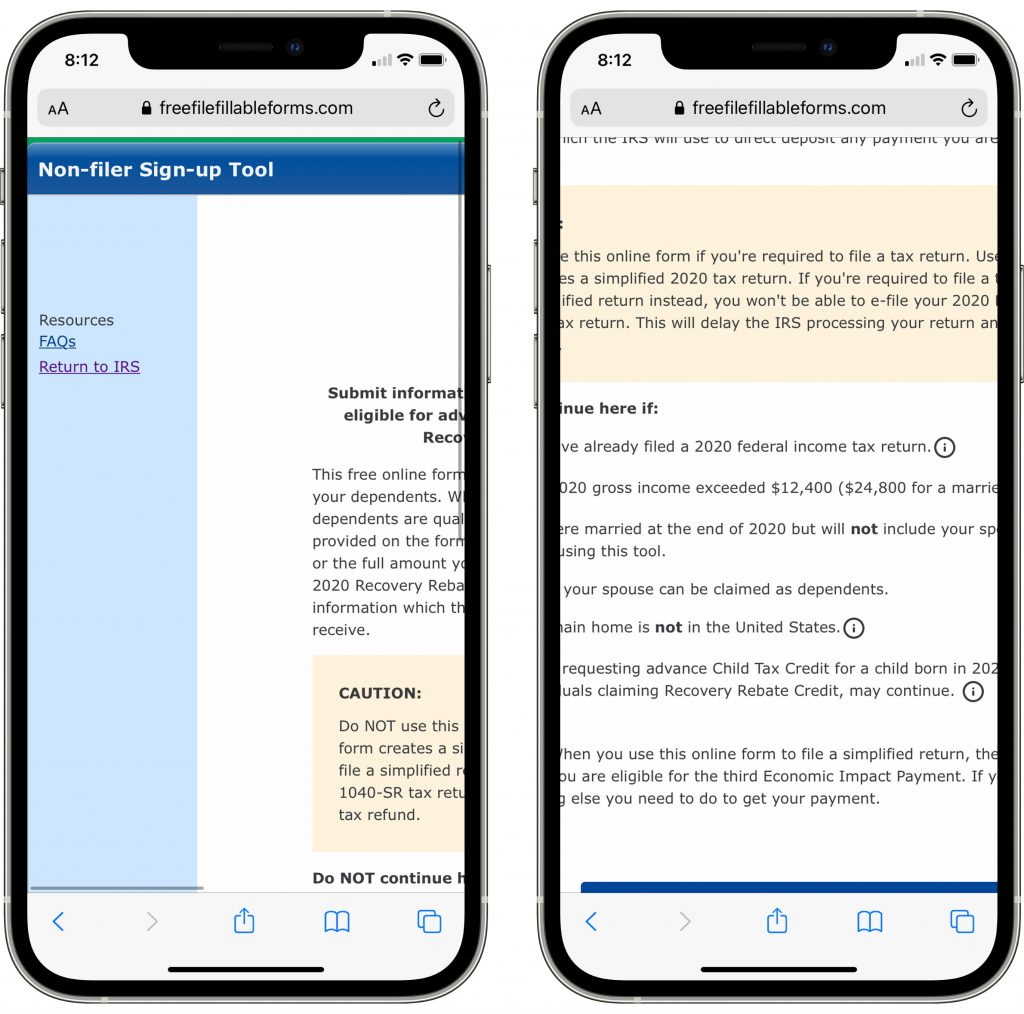

And here it is on mobile.

As Michelle Singletary reported at the Washington Post, this website is a disaster. Among other things:

- The website is not hosted on a .gov address. Instead, it is hosted at freefilefillableforms.com.

- The website’s URL, design, and lack of any indication that it has a formal affiliation with the IRS makes it look like a phishing scam.

- The website does not work on mobile devices even though poor people are far less likely to access the internet through laptop or desktop computers.

- The website is not available in Spanish even though Spanish speakers are overrepresented among non-filers.

- The website does not work with a screen reader.

- The website hits you with a wall of complicated and intimidating text and rules, including a literal caution box in the center.

In short, this looks like a website you would create if you were trying to get people to not sign up for the program. This should not be surprising of course, as this website was set up by Intuit, the makers of TurboTax, and they have a long track record of making it as hard as possible for people to file tax forms for free.

When the website was released, Paul E Williams published a piece here at People’s Policy Project detailing all its problems. But I decided that an even better way to drive home the level of incompetence involved in this website would be to simply create our own website to show how it should be done.

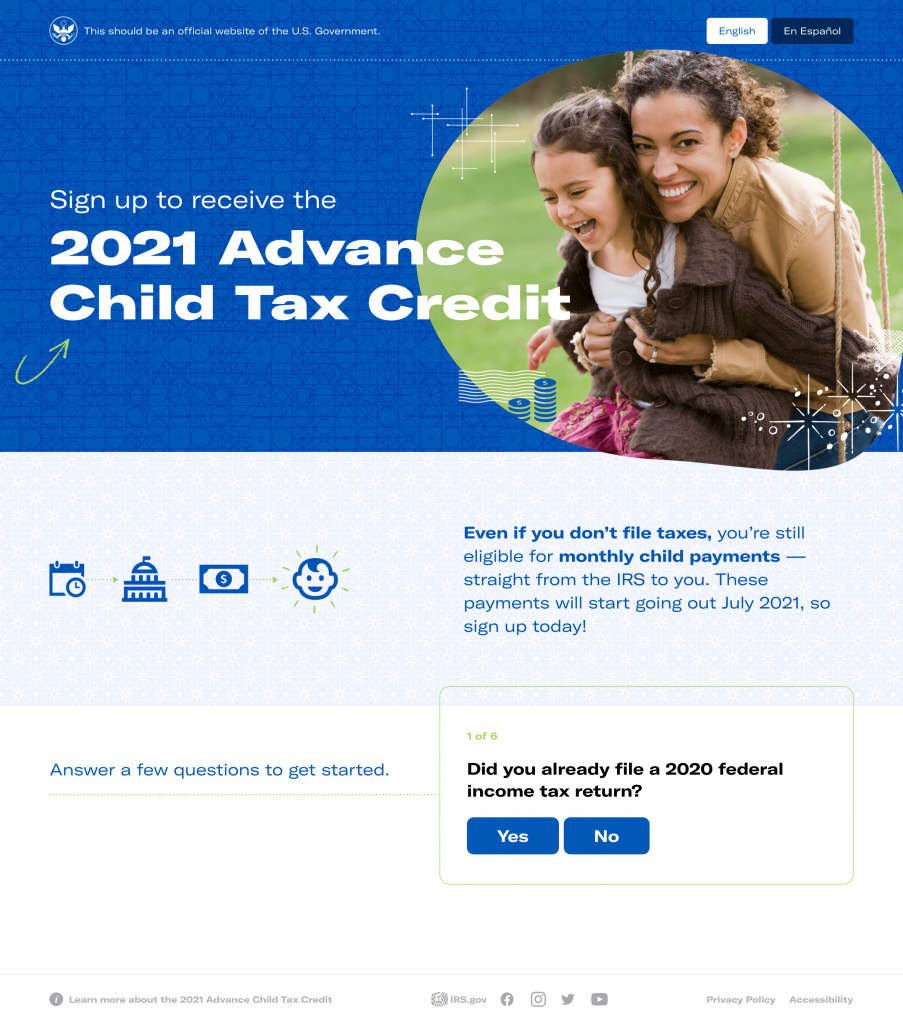

So I asked the best designer in the game, Jon White, to get cracking on making a better site and to keep close track of how long it takes him to produce the site from start to finish. In just 13 hours and 20 minutes, White delivered this site.

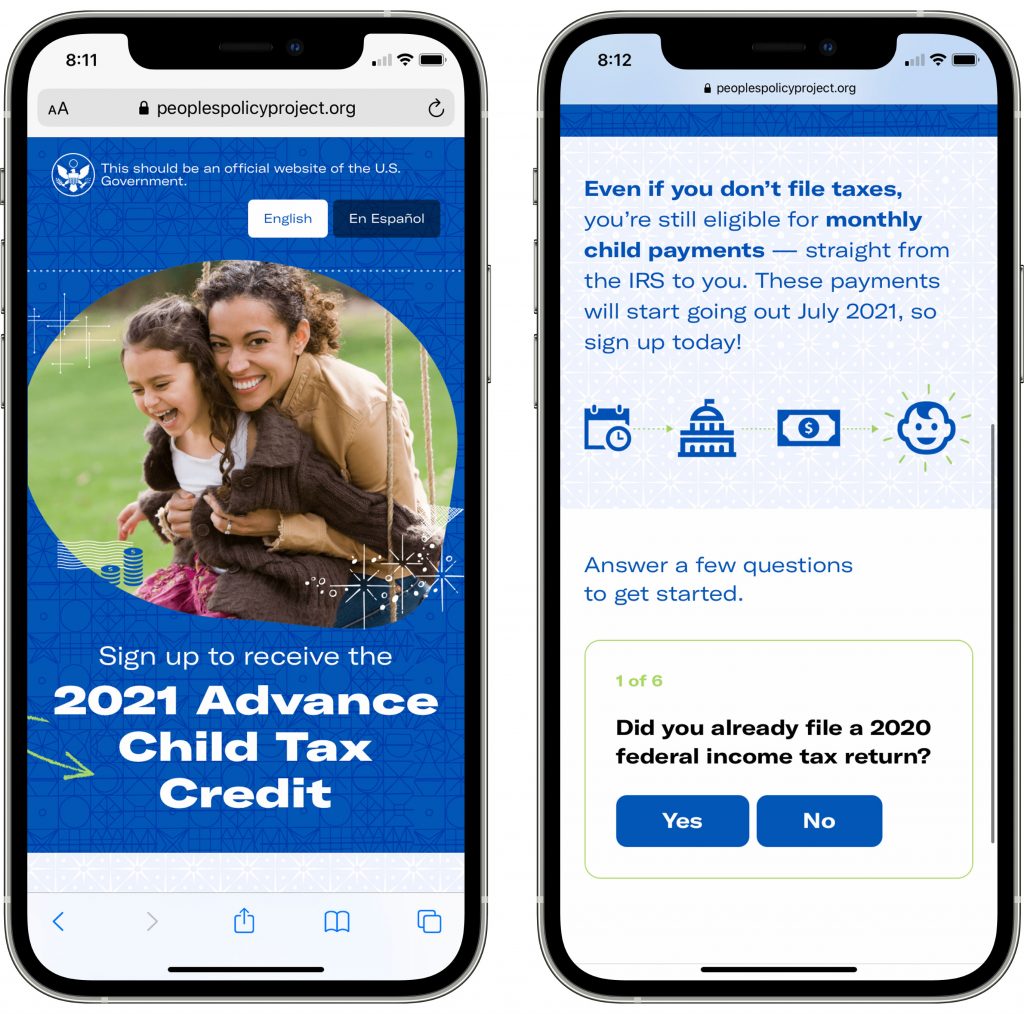

Here it is on mobile.

And here is a time lapse video of him making it.

Spanish translations were then provided by Enrique Olivo, who is apparently Canadian.

The site works on mobile, is available in Spanish, is not designed to look like a phishing website, is simple and inviting, and replaces the complicated set of eligibility rules with question prompts. The site eventually links back to the account creation page on freefilefillableforms.com because we don’t have e-file abilities here at People’s Policy Project. But the point remains: it is neither difficult nor time-consuming to create a website that doesn’t suck. That the IRS failed to do so should be seen as a scandal.

In recent days, White House messaging about the benefit seems to have shifted a bit. Brian Deese talked about it as a tax cut for middle-class families. Joe Biden’s twitter account promoted it by saying that “Nearly all working families will automatically get monthly payments starting July 15th – no action needed.” I may be overly sensitive to these kinds of things, but it sure looks like they’ve dropped their prior focus on child poverty, perhaps because they now realize it’s not likely to materialize given that the IRS still has no plausible way of reaching so many of those poor kids.

Up to this point, I have tried to avoid blaming the IRS for the bad program design decisions made by Congress. Those decisions were always going to make the IRS’s job very difficult, at least when it comes to reaching the non-filers that were the main selling point of the program. But even within those constraints, the IRS has now bungled the execution of the program and child poverty will be higher as a result.