The ongoing labor shortage has been misunderstood by red-state governors, and the Biden administration, as a problem caused by extended unemployment benefits during the pandemic.

In reality, job growth was no faster in states that ended federal unemployment assistance early, and states maintaining federal assistance (the extra $300/week, new benefits for gig workers, etc.) saw twice as much job growth in August as states that ended the benefits early. The latest jobs report, from the Bureau of Labor Statistics, indicated that only 194,000 jobs were added in September. If UI benefit cuts stimulated increased jobfinding, this number would be much larger.

So, what is going on in the labor market? What we know from the data may look contradictory, but it can be reconciled in a way that helps us think about the labor shortage more clearly, with an eye towards progressive policies that support job-seekers and the long-term unemployed during the Delta surge.

Here’s what we know:

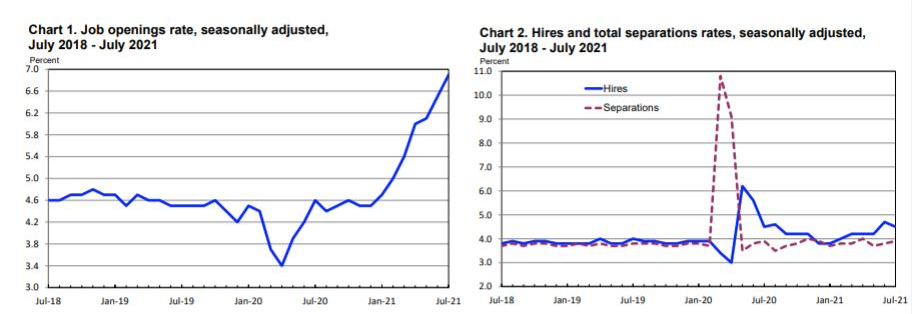

1. Job openings are at a record high, far above pre-pandemic levels.

According to the Bureau of Labor Statistics’ July 2021 data, there were 10.9 million job openings at the end of that month. This set a new record for the most job openings ever recorded, previously broken in June 2021 with roughly 10 million openings. But at the same time, there are only 8.4 million unemployed people actively seeking work – which reflects a larger mismatch in the labor market.

BLS couples its data on the growth or decline in job openings with a comparison of hires and separations (layoffs, people quitting, etc.). March 2020 saw a huge jump in separations over hires, pictured below, because of the start of lockdowns. But 2021 has mostly seen growth in hires above separations, with small variations.

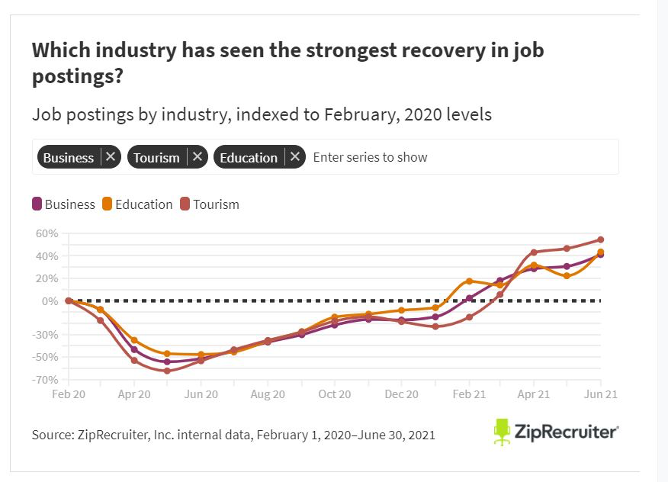

Chart 2 (right) suggests that the labor market is generally recovering (more people are being hired than fired), which is good news. The fact that job postings now exceed than their pre-pandemic levels may appear puzzling, but ZipRecruiter data confirms that job postings in June out-paced pre-pandemic levels in every industry, with minor variations. For example, transportation and storage saw a 232% jump in job postings compared to pre-pandemic levels, likely because of increases in online shopping. But even business, tourism, and education saw rapid and substantial growth in job postings.

A large reason for the discrepancies between job postings and hirings is what The Washington Post called the “Great Reassessment,” as many people decided during the pandemic to rethink their careers and not return to their former jobs immediately. Many states that saw the largest rate of new job postings also have decreasing populations, due in part to people moving across the country during the pandemic, and the death toll of COVID-19. Another geographic mismatch occurred within states, as many people moved out of cities to the suburbs and exurbs, and now prefer to work remotely.

Both factors help explain why, for each industry, job postings exceed hiring. But there are still apparently more jobs available than there are unemployed people who could fill those jobs. This has to do with another key data point:

2. The number of “missing workers” is higher than pre-pandemic levels as well.

“Missing workers,” according to the Economic Policy Institute, are typically those unemployed persons who are not actively seeking work because of limited to nonexistent opportunities. BLS found that labor force participation, as a percentage of the population, was 61.7% in August, down from February 2020 (63.3%). This August, 3.2 million people remained part of the long-term unemployed, and 2.5 million people were “permanent job losers.” These numbers, while declining, were higher than their February 2020 levels.

Major reasons for the unique rise in missing workers, according to Olivia Rockeman at Bloomberg, include early retirements by many Baby Boomers during the pandemic, increasing automation (for health and safety reasons), and continued difficulties for parents with accessing affordable childcare. The potential for a new wave of school and daycare closures exacerbates the latter problem.

Many people were out of work for an entire year due to pandemic layoffs and closures, and long-term unemployment is often a self-fulfilling prophecy: the longer someone is out of work, the harder it will be to get hired in the future. More people than during pre-pandemic times were thrown into a situation where they could end up among the missing workers, despite all the new job postings.

With this context in mind, there are two more data points that, all together, create a clearer picture of the labor market:

3. Extreme cuts to unemployment insurance only led to slight increases in job finding for UI recipients.

Arin Dube et al. recently found that job finding was only 4.4% higher in states that withdrew expanded unemployment benefits (a rate of 25.9%) than in states that retained them (21.9%). UI benefit cuts had a minimal impact on job finding because expanded benefits alone did not disincentivize most UI recipients from turning down good job offers. The Federal Reserve Bank of San Francisco found in June 2021 that only 7 out of every 28 people collecting expanded UI received “job offers that they would normally accept,” and only 1 out of the 7 declined offers they’d normally accept because of the $300 booster shot. Most UI recipients were not receiving job offers that fit their qualifications or interests, but the vast majority of recipients who did get such offers took those jobs over remaining on UI.

4. The slight increase in job finding, after UI benefit cuts, was entirely at the expense of job seekers not collecting UI.

Consequently, there has no gain in aggregate employment following UI benefit cuts. Economist Arin Dube calls this the “congestion effect”; he found, comparing states that withdrew and retained federal assistance, the slight increase in job finding by UI benefit recipients correlated with a comparable decline in job finding by teenagers. Because one population of job finders crowded out the other, there was no overall increase in hiring in July.

It may seem that there should not be a congestion effect when there are more job openings than unemployed people seeking work, because this presumptively reduces competition for positions. But the fact that there are more job openings than people seeking work, which does not usually hold during recessions, is unhelpful at the micro level. Every job someone applies for, even if it’s low-skilled, will have ample competition; even for retail or food service, UI benefit recipients and teenagers may be splitting the jobs and cancelling each other out.

More research is needed to determine the extent of the congestion effect by industry, to better understand the competition between UI benefit recipients and non-recipients (beyond teenagers). But all four data points listed here suggest an important conclusion about recent UI benefit cuts: the labor market deserves a more sophisticated understanding than what the Right’s narrative about UI can provide. Even with record-high job postings, the post-COVID recovery requires more public job training programs (which can reduce industry-specific shortages) and an expanded social safety net that prioritizes childcare access. Both would be an improvement over UI benefit cuts that misjudge key labor market trends.