After we switch to a single payer health care system, employers will no longer have to contribute money to private insurers. This fact creates an interesting question: what will become of that money?

Some critics of single payer maintain that this question represents a serious challenge to single payer plans. They say that this money could create an unjust windfall for employers that they will pocket rather than pass through to their workers in the form of higher cash wages.

This is not a completely ridiculous criticism, but it is also one that is very easy to overcome. As you will see below, it should be possible to create an employer-side payroll tax to capture the money employers currently pay to private insurers and thereby sidestep the question of whether employers will pocket it or pass it through to their workers. In addition to avoiding the pass-through issue, this solution also conveniently provides a lot of money to fund the new national health insurer.

Current Compensation Situation

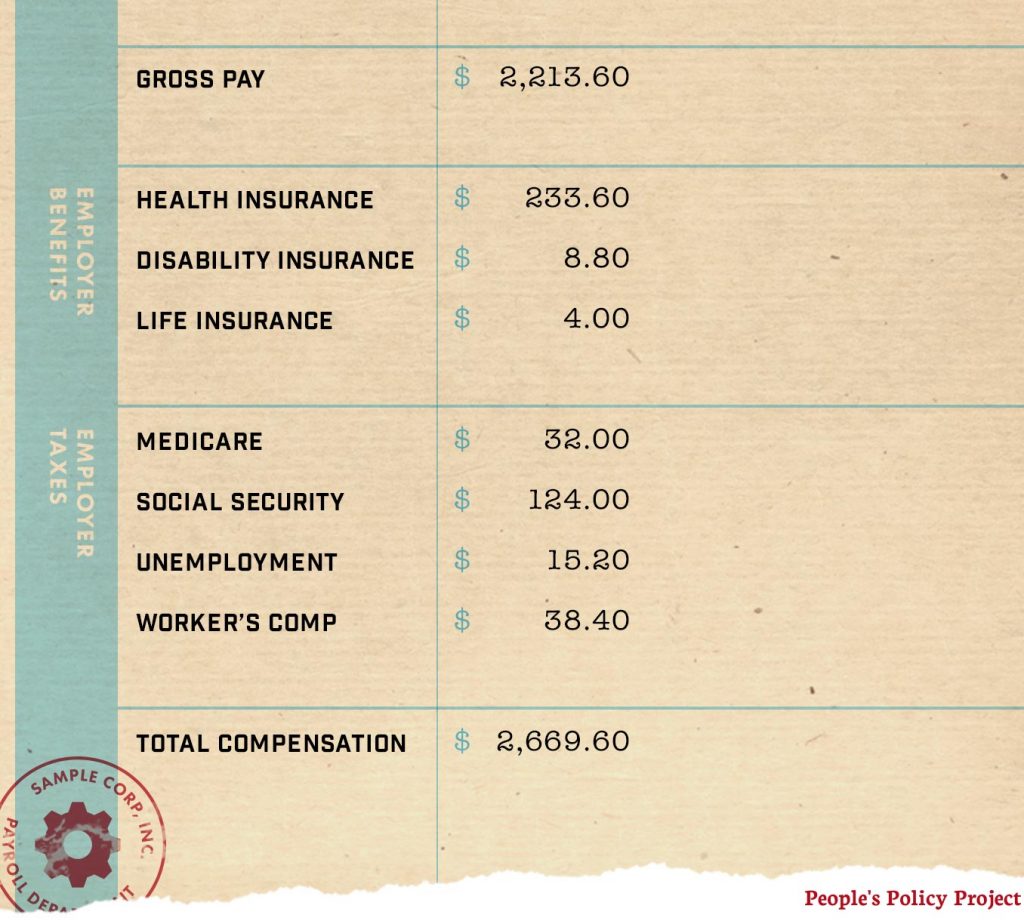

To fully understand the criticism and its solution, it is useful to start with an explanation of how employee compensation currently works in our country. To help this explanation along, I had Jon White create the following mock “pay stub” based on data from the national compensation survey.

Gross pay here refers to cash compensation. This is the amount of money people usually cite when they talk about how much they earn. So, for instance, if someone offers you a job with a $50,000 salary, what they usually mean is that the job will have a gross pay of $50,000.

Although we colloquially use gross pay to describe how much we earn, employers actually compensate employees more than that. In addition to gross pay, employers contribute money to private benefits like health insurance, disability insurance, and life insurance. They also pay employer-side payroll taxes to state and federal governments for programs like Medicare, Social Security, Unemployment Insurance, and Worker’s Compensation.

It is important for our purposes here to emphasize that employer-provided benefits and employer-side payroll taxes are paid by employers on top of wages. They are not formally deducted from an employee’s gross pay. They are provided in addition to that gross pay. This is why at the bottom of the above pay stub, total compensation is equal to all of the line items added together.

Naive Pass Through Scenario

If we were to simply relieve employers of the burden of paying for private health insurance, then that would mean that the “Health Insurance $233.60” line item would go away. Abstract theories of how employee compensation works suggest that the following would happen in this scenario.

In theory, an employer liberated from private health insurance premiums would pass the value of those premiums through to their workers in the form of higher gross pay. Thus, in the animation above, you see that health insurance is crossed out and the $233.60 premium migrates up to the top of the pay stub and is then added to the gross pay amount.

The reason why employers should do this in theory is because labor is supposedly compensated according to its marginal product and, in a competitive labor market, employers would be forced to plow their health care savings back into other forms of compensation to avoid losing their workers to other companies.

Objection

The objection to the naive pass through theory is that employers might pocket the money instead. So, rather than moving the money up to gross pay as in the above animation, they will use it to lower the amount of total compensation they provide to workers as in the below animation.

As you can see, here the $233.60 migrates down to the total compensation line and then is subtracted from that line. This represents employers pocketing the money rather than passing it through to their workers in the form of higher gross pay or some other type of compensation.

Generally people who raise this objection do not believe that employers will be able to permanently pocket this money. Rather they believe that this could happen in the short term before compensation levels have readjusted to this shock. That is, they believe that these savings would eventually get passed through to workers through higher gross pay, but are nonetheless worried that employers would enjoy an unjust temporary windfall.

Solution

It is impossible to say whether this objection would actually materialize. But if we are worried that it might, there is an easy solution. By increasing employer-side payroll taxes by an amount equal to the private premiums employers no longer have to pay, the government can capture these savings directly. This solution is illustrated in the following animation.

Here the employer is relieved from paying $233.60 in private health insurance premiums, but then employer-side Medicare taxes are raised by $233.60. So, the savings are neither passed through to employees through higher gross pay nor pocketed by the employer through lower total compensation. Instead, the money currently being paid by employers into the private health insurance system is simply redirected into the public health insurance system with everything else about compensation remaining unchanged.

It is important to emphasize here that this not only solves the pass through problem, but also should provide an enormous amount of revenue to help fund the single-payer system.

Plans Already Do This

The idea of capturing the amount of money employers currently pay in private premiums through an employer-side payroll tax is present in almost every proposal out there for financing a single payer system.

In Sanders’ latest release, the very first financing idea is a “7.5 percent income-based premium paid by employers.” This tax rate appears to me to be too low. Some back of the envelope calculations based on the national compensation survey suggest it should probably be closer to 10 percent. But regardless of where the rate is set, the general idea is the same as above and is exactly the right approach.

This tax would not fund the entirety of a single payer system. This is obvious since employers are not the only people who currently pump money into private insurance. But it would get us a big chunk of the way there.

This is the third post in our Single Payer Myths series. The series tackles common arguments against a single payer system one at a time.