Jim Geraghty has a piece at the National Review about why the Nordic countries are bad. The piece contains a lot of clear mistakes that are worth addressing, which I will do here.

Conservatives Split on How to Understand the Nordics

Before we begin, it is helpful to situate Geragthy’s piece in the conservative literature on the Nordic countries. When conservatives write about the Nordic countries, they say one of two things.

The first thing they say is that the Nordic countries are quite good, but that they are actually more capitalistic than the US. Kevin Williamson, also writing in the National Review, has taken this approach.

For those of you who are keeping score, the Heritage Foundation, which literally keeps score, rates Denmark’s economy as slightly more free – slightly more capitalistic — than that of the United States.

This quote refers to the same Heritage Foundation index that says Singapore is the second most capitalistic country in the world despite the fact that the Singaporean government owns virtually all the land and housing in the country as well as large chunks of the country’s major companies. But putting aside the specific citation, the move here is clear: concede that the countries are quite good, but then do everything you can to say that this is because of capitalism.

The second thing they say is that the Nordic countries are quite socialist, but that they do quite bad as a result. This is how Ben Shapiro used to deal with the countries.

As always, the theory of Marxism is never to blame for the failure of Marxism. And Denmark is yet another example of how socialism can hamstring an economy.

All conservatives writing in this genre reach the conclusion that the Nordics prove that capitalism is good and socialism is bad, but they cannot decide among themselves whether the Nordics are a positive example of capitalism or a negative example of socialism. Geraghty’s piece falls into the latter category, though frankly that seems to be out of step with the conservative trend on the subject these days.

Geraghty Mistake Number One: Innovation

Geraghty claims that the Nordic countries kill innovation. In support of this claim, he cites to a widely-criticized Daron Acemoglu paper that made the same assertion. Acemoglu attempted to prove his claim by comparing the number of US patents issued to Nordic nationals versus US nationals.

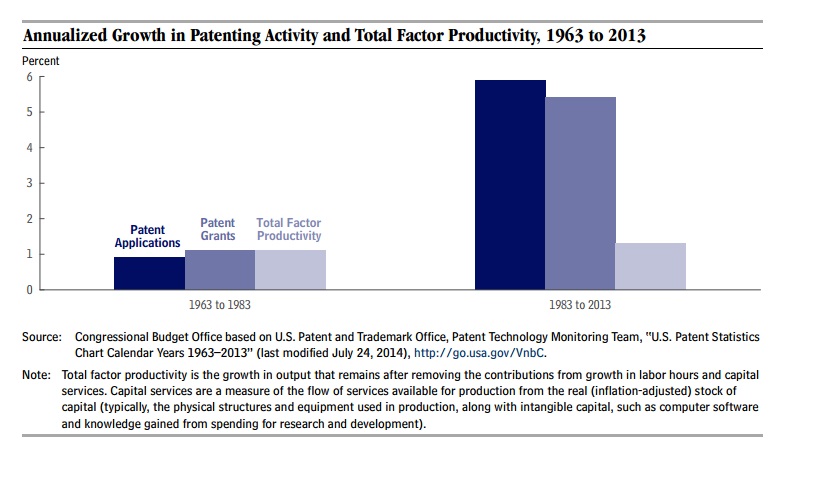

The problem is that this is a completely ridiculous metric. Patents, especially in the US, are not a reliable indicator of innovation, but rather of patent trolling. We know this because in the last few decades, the US has seen an explosion in patenting activity but no corresponding rise in total factor productivity.

Additionally, other less problematic metrics of innovation do not support Acemoglu’s claims. The Nordic countries have higher business research and development spending, more venture capital investment, and file more triadic patents (i.e. patents filed simultaneously in Japan, Europe, and the US). It’s also worth noting that the Global Innovation Index ranks Sweden (2) ahead of the US (4) while ranking Denmark (6) and Finland (8) nearby.

Geraghty Mistake Number Two: Startups

Geraghty claims that the Nordic countries “crushed startups and the growth of new companies.” In fact, the Nordic countries tend to have higher startup rates than the US has. The OECD tracks a statistic called the enterprise birth rate, which is calculated as the percent of businesses that are less than a year old. For 2007, in the US, the figure was 8.5 percent; in Sweden, it was 10.3 percent; in Finland, it was 11.9 percent; and in Denmark, it was 12.2 percent.

As to whether any of these new companies are successful, the answer is certainly yes. As Murad Ahmed wrote in the Financial Times in 2015, Stockholm in Sweden is a veritable unicorn factory, meaning that it produces a heavily disproportionate share of billion dollar companies:

According to a study by Atomico, “on a per-capita basis, Stockholm is the second most prolific tech hub globally, with 6.3 billion-dollar companies per million people compared to Silicon Valley with 6.9”.

The past decade’s local successes include internet calls service Skype (bought by Microsoft for $8.5bn in 2011), music streaming service Spotify (valued at $8bn), online gaming company King Digital, the company behind Candy Crush Saga (market capitalisation of $4.9bn), Minecraft-maker Mojang, (sold last year to Microsoft for $2.5bn) and web payments service Klarna (valued at $1.4bn).

Geraghty Mistake Number Three: Household Debt

Geraghty’s last factual mistake is about household finances:

If the government is paying for everything, why is Denmark’s average household debt as a share of disposable income three times that of the United States? Meanwhile, the household-debt share in both Sweden and Norway is close to double that of the United States. The cost of living is particularly high in these countries, and the high taxation means take-home pay is much less than it is under our system.

Household debt needs to be counted alongside household assets. Anyone who has ever bought a home with a mortgage understands why. When you look at household net worth as a percent of disposable income, it is 580 percent in the US versus 555 percent in Denmark. In Sweden it is 528 percent. In Finland and Norway, where the states own much larger shares of the national wealth, it is 318 percent and 347 percent. In all cases, even in the more socialized Finnish and Norwegian economies where the national wealth is held more collectively, households own at least 3x annual income on average, and this is not even to get into how much more evenly household wealth is distributed in these countries.